NB Budget 2020: Is Demographics Destiny?

At the time of writing, this budget may or may not pass, due to it being a minority government. Budget approvals are always considered confidence votes, so if it is not approved, expect an election. In any case, I decided to write my annual summary anyway.

As per usual, I'll try to keep most of the amounts in millions (M) of dollars (CAD) because I think it's easier to compare than mixing million and billions. And while I'll mostly refer to it as the 2020 budget, it is technically for the 2020-2021 fiscal year. This is probably also a good spot to point out that the provincial government has a handy new dashboard for the New Brunswick economy.

Updates on Expenditures and Revenue

To start with, here are some of the key estimates in the provincial budget for the fiscal year ahead:

- Projected total revenues of $10278M

- Projected total expenditures of $10186M

- A projected surplus of $92M

- Projected net debt of $13681M this time next year

The net debt by the end of the fiscal year will represent around 35% of GDP (assuming the economy stays relatively stable).

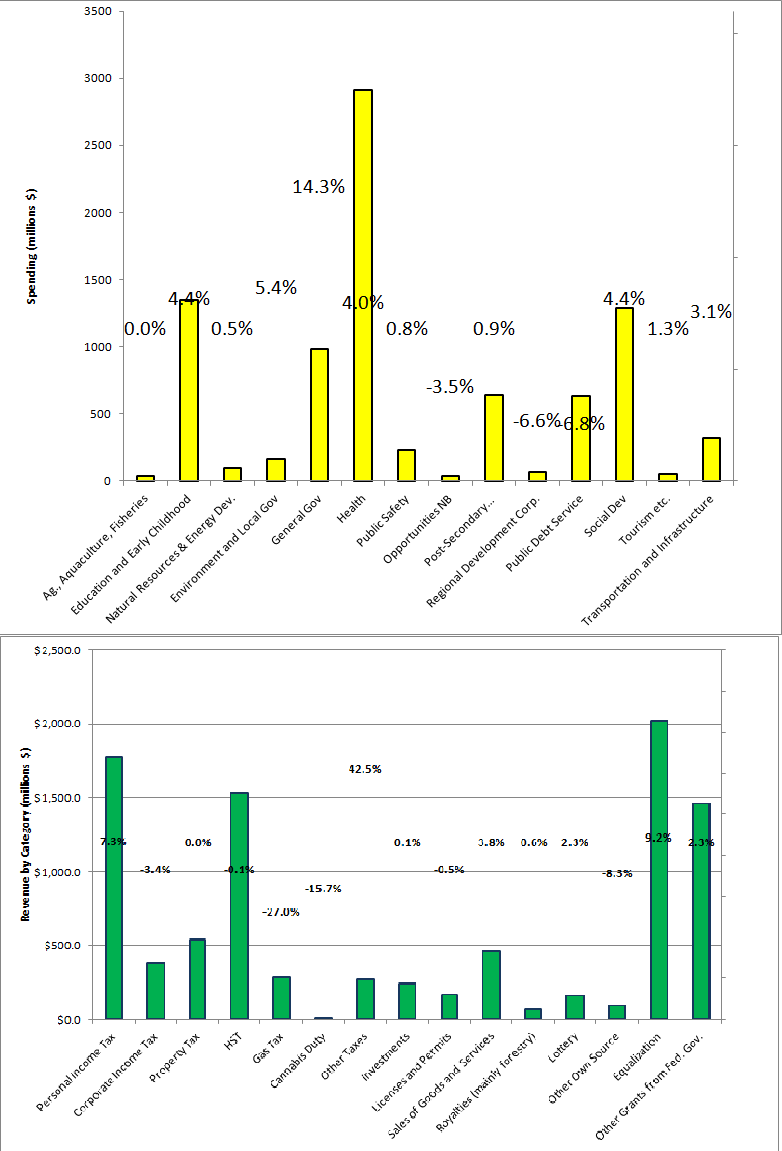

The departments with the largest budgets for the upcoming fiscal year are as follows (these figures and the following graph are for their ordinary accounts which don't include capital spending, amortization, etc.):

- Health: $2915M

- Education and Early Childhood Development: $1351M

- Social Development: $1289M

- General Government: $981M

- Post-Secondary Education, Training, and Labour: $642M

- Debt Service: $631M

- Transportation and Infrastructure: $321M

- Public Safety: $229M

One notable change is that the amount that has to be spent on debt service is declining as a result of back-to-back balanced budgets, and now is less than what is spent on colleges and universities (and the other things within that department).

On the revenue side of the 2020 budget, the major anticipated sources of revenue for the Government of New Brunswick include:

- Taxes: $4944M

- Equalization Payments: $2210M

- Other grants from the Federal government: $1495M

- Other self-generated revenue (Licenses, Royalties, Lottery, Etc.): $1206M

The taxes are spread among a number of categories (income, sales, property, corporate income, gas, carbon, tobacco, etc.), so "Fiscal Equalization Payments" represents the single largest line item.

The following pair of graphs show the budgeted expenditures by department and the budgeted revenue by source. Both of them have the change from how much was budgeted in that category last year noted.

For the first figure, there are some small departments such as the Finance and Treasury Board, and the Office of the Premier that I didn't include. Some notable changes from last year's budget include $46M less that needs to be spent on servicing the public debt, increases of around $55M to the departments of Education and Social Development, and increases of over $100M to the departments of Health and General Government. The latter had the largest percentage increase. It is accounted for by the introduction of a climate change investment fund and a natural gas distribution subsidy, along with budgeting for the deployment of ERP software and increased contingency in a "supplemental funding" bucket (apparently as an allowance pending the resolution of some collective bargaining agreements).

For the second figure, a notable change was separating the carbon tax (included as part of "Other Taxes" on the graph) from the gas tax, which explains the changes to those items. I'll also note some proposed reductions in property tax rates, although the revenue from those taxes isn't projected to change; whether due to it being counterbalanced by the expected increase in the size of the tax base, or due to a delay before the changes take effect, I'm not sure.

Equaliz(n)ation

Equalization payments increased by $187M over what was budgeted last year. This is because NB is the most "have-not" province in Canada. The posted budget surplus would not have been possible without this increase. I think it is wise to put the increased equalization payments toward paying down the provincial debt (and thus freeing up money that otherwise would have had to go to interest payments in future years) because I'm not sure they can be counted on to stay at their current level for too long. If the recent drop in oil prices holds, the economies of "have" provinces like Alberta could suffer—at a time when resentment against being on the paying end is already growing:

5) The status quo of the Equalization program is fueling western alienation. Many are asking for the elimination, or the phase out, of the Equalization program in addition to retroactively lifting the cap on the Fiscal Stabilization Fund, which is already supported by all provinces and territories. An immediate change to the Equalization program should include treating all resource revenues in each province/territory the same under the program. These changes would acknowledge that programs like the Canada Health Transfer and the Canada Social Transfer already provide equitable stable funding for provincial social programs, would ensure all regions are treated equally, and would serve to remove disincentives for provinces to improve their fiscal situations.

This excerpt is from a manifesto that is unlikely to be implemented as-is (at least in my opinion). But the sentiment behind it is likely to be part of the national conversation in the years ahead. An adjustment to the Equalization formula may thus become a political necessity for the federal government; any adjustment is unlikely to benefit New Brunswick so being in a flexible fiscal position to deal with diminished revenue from this source would be prudent.

The Implications of An Aging Population

David Campbell had an eye-opening post about the demographics of NB a bit over a year ago:

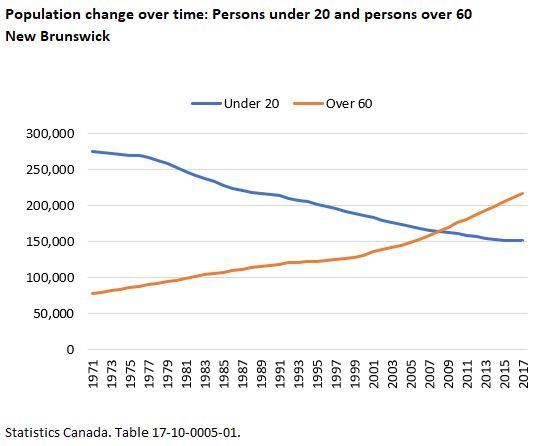

In 1971 there were 351 people living in New Brunswick under the age of 20 for every 100 aged 60 and older. In 2017 there were 70 under the age of 20 for every 100 aged 60 and older. Of all the demographic and socio-economic changes in New Brunswick over the past 40ish years, this one is arguably the most profound. By the way the breakeven point – was only in 2007 – the year there were the same under 20 as over 60. Now the trend lines are diverging in a significant way.

It included this graph, which I've reshared for discussion purposes:

While the decline in the youth population appears to have been arrested for now, the growing population of seniors is likely to be a key factor in the economy and politics of the province for years to come.

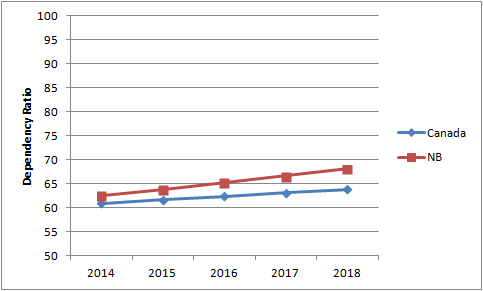

Another way of looking at this topic is through the "Dependency Ratio" statistics kept by Stats Canada. They define this as the number of people too young or too old to be in the main bracket of the workforce (i.e. less than 20 or 65+) per 100 people in the working age population. As of 2018 (the most recent year with available data), this was 68.1 in NB compared to 63.8 in Canada as a whole. As this ratio increases, there are fewer people in the working age population to support students and retirees.

When you also look at stats like the labour force participation rate and unemployment rate (61.1% and 6.9%, respectively), the number of people employed in New Brunswick is only 46% of the population (381,000 / 780,000).

Putting these trends together means that services such as health care (and nursing homes, which account for $367M of the Social Development budget) that are especially needed by the elderly are likely to see steadily increasing demand without a corresponding boost to the capacity to fund them (the Dept. of Health budget has increased by 11% in the past five years by my calculations, so it's not like it is being neglected). Indeed, hospitals and nursing homes have been the focus of political disputes recently. At the same time, it could get politically easier to say "not in my backyard" to projects that could generate new jobs, since people that need jobs are in the minority. I see this as a recipe for inter-generational conflict. For example, it would be easy for seniors to think that they worked hard all their lives and now services they were counting on are strained or have limited availability; meanwhile, younger generations might feel that they've got an unfair load to bear as a result of the dependency ratio getting into uncharted territory.

That's not the future I want for NB (however we got here, let's recognize that we're in this boat together), so I'll finish this post by pointing out the hopeful and ambitious plan outlined in the state of the province address:

[Premier Higgs] explained a three-part strategy, including increasing immigration to 10,000 per year – from the current target of 7,500 – by 2027. A marketing campaign to repatriate New Brunswickers will also be rolled out, along with initiatives aimed to help newcomers get credentials quicker and have less red tape when starting a business.

The goal of these measures—and I'd add let's try having more kids here too—is to reach a population of 1 million people in 2040.

References

- The main budget document

- CBC article

- More graphs from David Campbell

- Relevant Wikipedia article