NB Budget 2023: Healthcare Redux

Our provincial net debt in New Brunswick is now smaller than the size of the annual budget.

The topic of healthcare is too broad to do it justice in a single post (or in two either, to be fair, but I'll make an attempt), so I'm continuing to examine it in this year's budget write-up.

Last year, I looked at some big picture statistics that showed New Brunswick isn't really under-investing in healthcare compared to other provinces or peer countries. The strain on the system has more to do with the ever-rising demands imposed by an aging population than with political neglect. Indeed, healthcare systems in more than one peer country (e.g. UK and Germany, which also have aging populations) are bursting at the seams in the same way as here in Canada. In this year's post, I want to get into more of the concrete details of the operations of the regional health authorities.

As per usual, I'll try to keep most of the amounts in millions (M) of dollars (CAD) because I think it's easier to compare than mixing million and billions. And while I'll mostly refer to it as the 2023 budget, it is technically for the 2023-2024 fiscal year. Also per usual, I'll try to primarily focus on the facts and figures rather than opinion/commentary.

Updates on Expenditures and Revenue

To start with, here are some of the key estimates in the provincial budget for the fiscal year ahead:

- Projected total revenues of $12193M

- Projected total expenditures of $12152M

- A projected surplus of $40M

- Projected net debt of $11796M this time next year

The net debt will now be less than the annual budget, and only around 25% of provincial GDP (assuming the economy stays relatively stable). It is also less than it was when I started writing these posts in 2015 (i.e. $12600M).

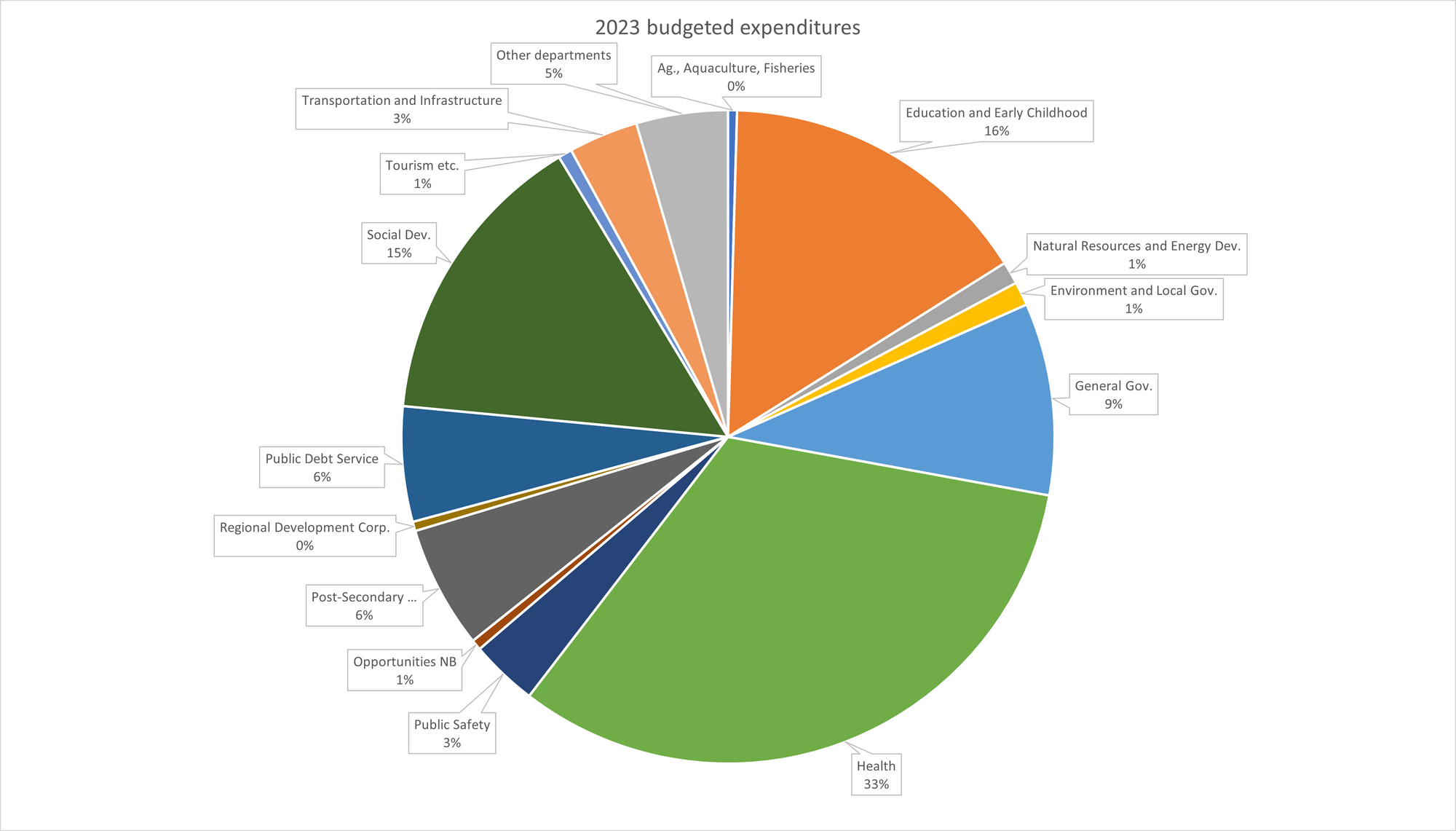

The departments with the largest budgets for the upcoming fiscal year are as follows (these figures and the following graph are for their ordinary accounts which don't include capital spending, amortization, etc.):

- Health: $3584M

- Education and Early Childhood Development: $1721M

- Social Development: $1634M

- General Government: $1047M

- Post-Secondary Education, Training, and Labour: $669M

- Debt Service: $627M

- Transportation and Infrastructure: $379M

- Public Safety: $367M

There was a 10.7% increase in the funding for the department of health and an 9.4% increase in the funding for the department of education and early childhood development over what was budgeted last year. The department of social development had a 11.3% increase. There was a large increase in percentage terms (although a much smaller absolute increase compared to the larger departments) to Natural Resources and Energy Development, which seems to mainly be about a new Energy Efficiency fund. There were also increases to the Justice/Public Safety department for more funding for the RCMP and corrections officers. A notable decrease (over 20%) was to the department of Environment and Local Government, which I assume is anticipated savings (or reconfigured spending anyway) from recent restructuring of local government in NB (I had a short discussion of how things used to be here).

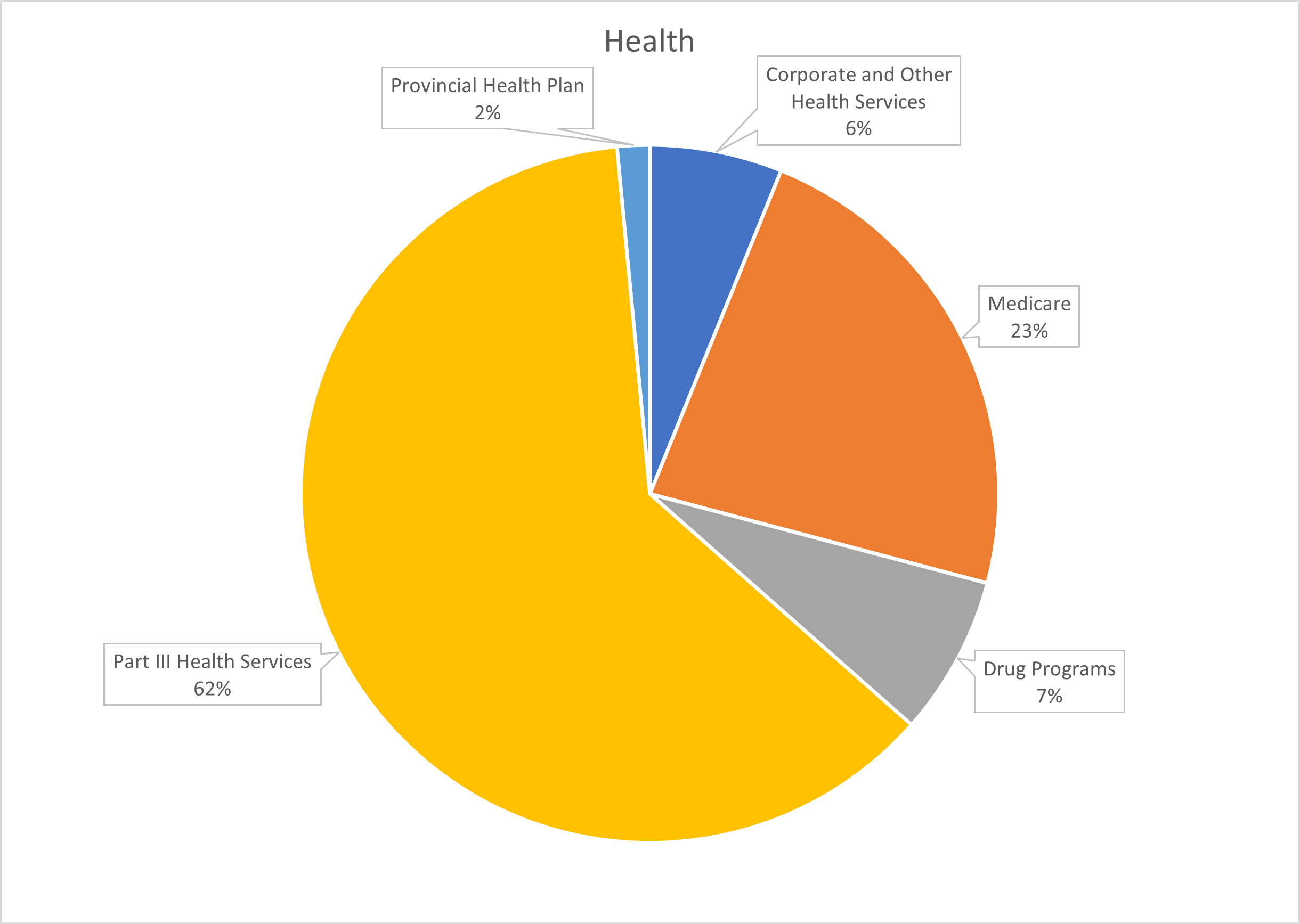

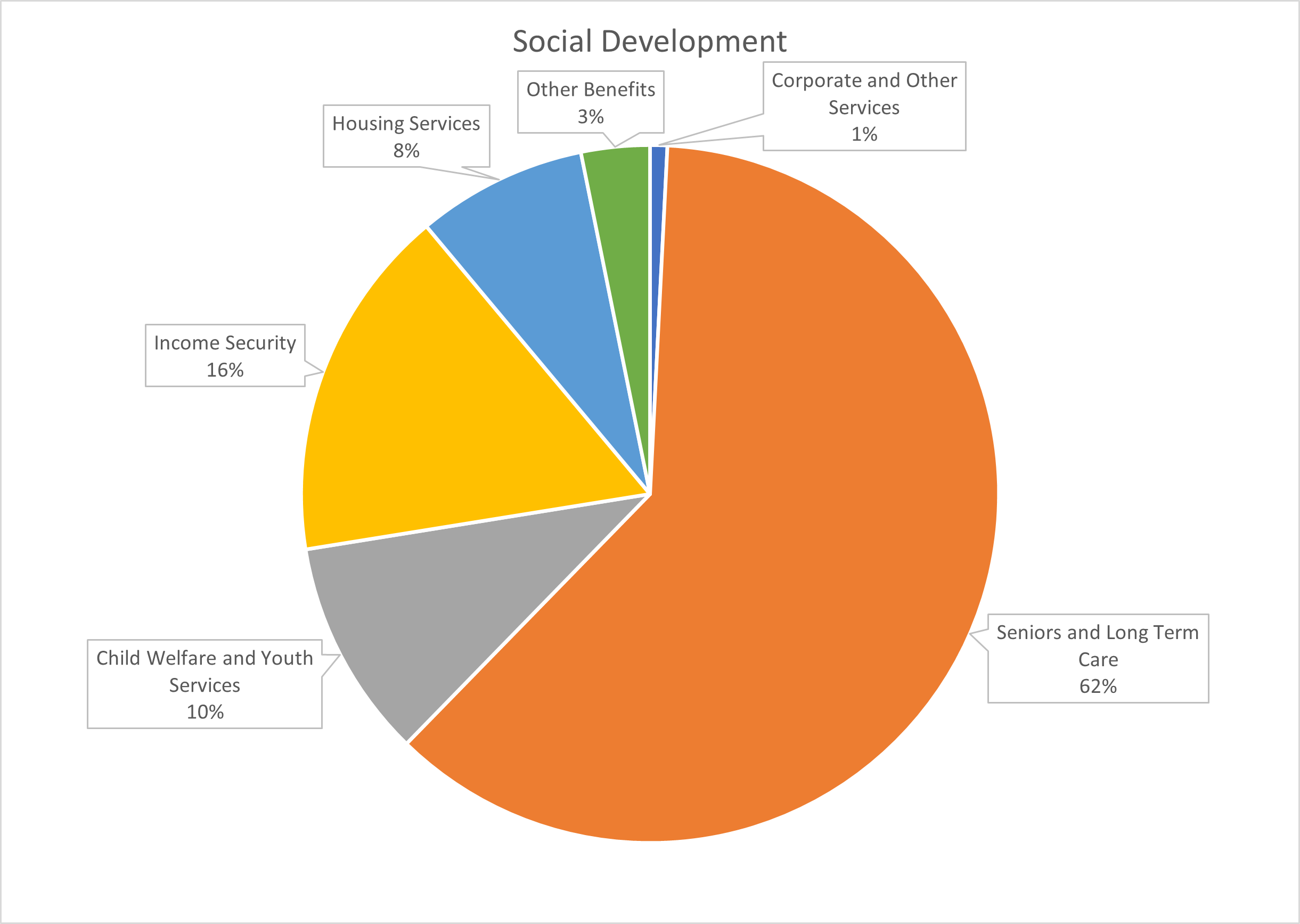

Here are a few graphs related to expenditures: an overall pie chart of spending by department, and breakdowns within 2 of the 3 largest departments (78% of the spending within Education and Early Childhood Development goes to school districts, so it would have been a boring pie chart):

Because inflation has been quite high recently, I wanted to see how the increases to the budget compared to that. Looking back pre-Covid to the 2019 budget, it had $9823M in Expenditures. Cumulative inflation from 2019 to 2023 has been 14.87%, so $11284M would be needed just to keep up. Looking at the actual 2023 budget, it has increased by 7.7% over and above inflation since 2019.

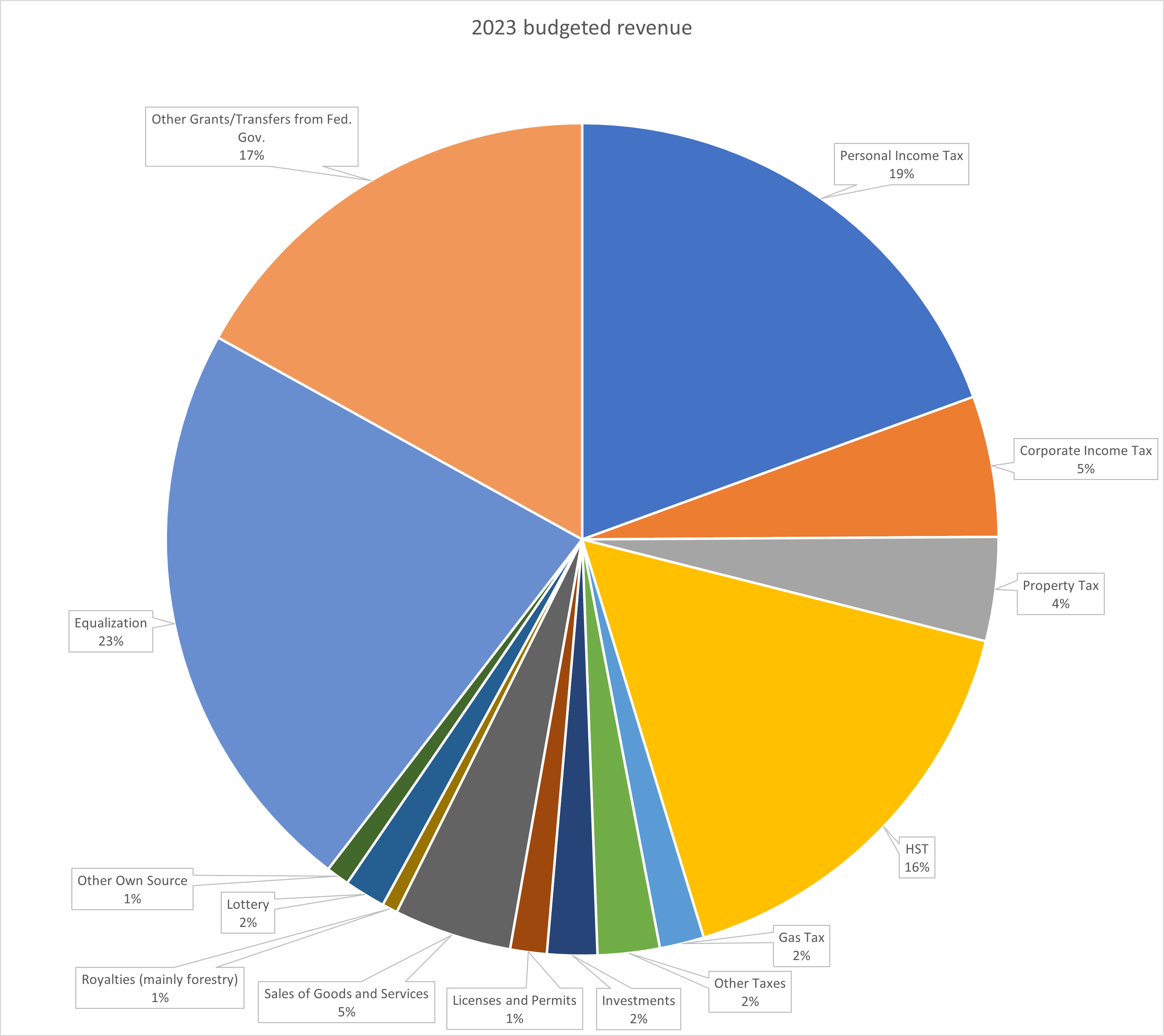

On the revenue side of the 2023 budget, the major anticipated sources of revenue for the Government of New Brunswick include:

- Taxes: $5748M

- Equalization Payments: $2631M

- Other grants from the Federal government: $1971M

- Other self-generated revenue (Licenses, Royalties, Lottery, Etc.): $1283M

Here is a graph of revenue by source budgeted for the fiscal year ahead:

The increase anticipated in income (personal and corporate) tax and sales tax revenue comes from a growing economy and expanding tax base rather than increases in rates. In fact, the 2023 budget is expecting less revenue in these categories than was actually received last year—but significantly more than was in last year's budget. There was a very large surplus from the fiscal year just ending, in large part because the tax revenue came in much higher than expected. There is some debate over how much of that increase is permanent versus a one-time windfall, so the new 2023 budget projects revenue in these categories somewhere between what was expected and what was actually received in the 2022 fiscal year. With a possible recession on the horizon, this seems like a pragmatic approach to me, but not everyone sees it that way.

Property tax revenues are anticipated to decline, which does appear to be related to rate changes, specifically rate reductions affecting residential rental properties.

Equalization payments are growing. These are calculated on a per capita basis, so a growing population is driving this. Under the category of "Other Transfers from the Federal Government", the "Conditional Health Transfer" increased from $81M to $168M as well.

Healthcare Operational Metrics

I took a look at the Government of New Brunswick's annual report on hospital services as well as the annual report for Horizon Health, the English-language Regional Health Authority (see here and here for archives of these documents from previous years). Both of these documents were published last year and cover the 2020-2021 or 2021-2022 fiscal year; the ones for last year haven't been released yet, and because the budget is a forward-looking document, these reports would actually correspond to the budget from 2 or 3 years ago. With that caveat that the information is slightly out of date, here are some interesting facts and figures I found:

- In 2020-2021, expenses for Horizon (RHA B in the first report) were $1395M and for Vitalité (RRS A) they were $840M. Both Regional Health Authorities had 80-83% of their costs associated with acute care facilities (i.e. hospitals), but also have some other types of facilities under their umbrellas (community health centres, rehab centres, psychiatric facilities, etc.).

- Salaries accounted for around 60-65% of costs, with benefits contributing another ~7%. Healthcare is a labour-intensive field, so this dwarfs things like supplies, equipment, and facility maintenance.

- Administrative and support functions cost $205M (15%) for Horizon and $160M (19%) for Vitalité in 2020-2021. This is a similar magnitude to Diagnostic & Therapeutic functions and less than inpatient nursing.

- In 2020-2021, Horizon Health had 17.7 million person-hours worked and Vitalité had 10 million. Extra-mural and the ambulance service contributed another 1.2 million. All told, this represents over 18,000 full-time equivalent (FTE) employees.

- Inpatient nursing accounts for 25-30% of the FTEs.

- 67% of employees are classified as full-time, and 85% are permanent.

- The age distribution is pretty uniform: 28.7% are under 35, 24.2% are 35-45, 25.6% are 45-55, and 21.6% are 55 or older.

- The average length of stay in hospital in 2020-2021 was around 8 days, with almost 74,000 total cases. This is for "acute care". For "chronic/extended care" there were 2,500 cases with an average length of stay of 70 days.

- The hospital services report goes on to give table after table about the numbers of different types of surgeries performed, but I wasn't interested in that level of detail.

- Specific to Horizon Health (as of 2021-2022), their corporate profile is that they have a budget of around $1300M, 14,000 employees, and 1,200 physicians. They operate 12 hospitals and over 100 facilities in total including all the various clinics, offices, etc.

- Horizon has 1,622 hospital beds. In 2021-2022, they had around 51,000 admissions and 39,000 surgeries performed. Four hospitals had above a 90% occupancy rate: Sussex, Perth-Andover, Upper River Valley/Waterville, and Fredericton.

- There were 270,000 emergency department visits across the Horizon network.

Note that all of these statistics are from a time period that was impacted by the pandemic.

You often hear about rapidly-expanding administrations as a driver for costs in some sectors. For example, Yale University has more administrators than students and Stanford has more staff (counting faculty and administration, but with almost seven times more administration that faculty) than students. So it is good to see that in New Brunswick hospitals front-line roles outnumber administrative and support functions (not that these don't matter, but it's about where you keep the focus).

Looking Beyond Our Borders and Past the Next Election

I generally try to keep these budget review posts focused on the facts—and maybe some forecasts/predictions—rather than my opinions, but I feel this point is worth making an exception for. The government of NB has faced vocal pressure to loosen the purse strings instead of paying down the debt. I hope they continue to hold the line on this. Yes, the healthcare system and other provincial services are under a lot of strain. If it was a short-term crisis that would be one thing, but I believe this is the new normal and we have to figure out how to make things work—within our means!—in the situation we find ourselves in. The demographic realities aren't going away. Hopefully the economic situation improves somewhat as the disruption of the pandemic fades in the rearview mirror, but I don't know anyone serious who expects the combination of near-zero interest rates and sub-2% inflation to come back anytime soon. Put together, I believe we need to steward our resources for increased challenges ahead, or at least the potential for such. The good news is that a growing population and a falling debt give more room to manoeuvre, and we'll probably end up glad that we kept our powder dry for the back half of the 2020s. To be very blunt, I think it's at least possible that we're still in the calm before the storm (in terms of demographic-driven demand increases and labour crunches, the monetary environment, and the intrusion of outside events inter alia).

My post from a few years ago (mere weeks before the Covid-19 lockdowns began) focused on demographic pressure on NB's fiscal situation (i.e. the dependency ratio and related topics). I encourage you to go back and re-read the final section. In the years since, things have actually improved quite a bit on that front, with the population of the province growing again after years of stagnation. This probably was driven at least as much by external factors (e.g. increased remote work, desires of families to get out of crowded cities, and housing that's more affordable compared to the rest of the country—scant comfort though that may be to New Brunswickers trying to buy a home right now) as by political effort, but at least the provincial government (and local municipalities too) haven't gotten in the way of it yet. I appreciated what David Campbell had to say on the pains of growth being better than the pains of shrinking.

For a view of what our future as a province could have looked like if we'd stayed on the path we were on, of a stagnant population and growing debt, look at Newfoundland and Labrador. They are the most indebted province in Canada on a per-capita basis and are even resorting to foreign bond markets (not necessarily a bad thing in itself, just a sign that juggling the debt around is taking up more of their leaders' time and attention). In the years to come, I expect they'll see widespread service shortages/cuts (e.g. more frequent hospital closures), maybe a bail-out from the Feds [again], and struggle to balance the budget even so.

Further to the point about demographics, The End of the World is Just the Beginning by Peter Zeihan (which I reviewed here) has a lot to say on this topic. Including this prediction:

much of the world’s population faces mass retirements followed by population crashes at roughly the same time. The world’s demographic structure passed the point of no return twenty to forty years ago. The 2020s are the decade when it all breaks apart.

Here is a recent video he did about Canada's situation in this regard. The protests in France over raising the retirement age to 64 demonstrate that the challenges posed by aging populations are not restricted to one country but span most of the developped world. And they can limit our options for dealing with some of the other challenges we face (e.g. trying to transition to new sources of energy, increasingly aggressive hostile superpowers).

The past month has brought some vivid illustrations of the precarious balancing act that is the current monetary policy environment. There were 3 or 4 weekends in a row (hopefully contained now) that saw banks in the US or Europe (including a Swiss bank!) in business on Friday and not on Monday. These happenings were related to the bond market, which is inextricably linked to government debts. See the graph of unrealized losses for US banks in this explanatory article on recent bank collapses. If I understand correctly, rising interest rates lower the market value of bonds. Monetary policy is caught between a rock and a hard place: they want to raise interest rates to control inflation, but raising it too much means that governments can't get as good of terms on their own debts, and also increases risks that other borrowers will default, which then ripples out into the rest of the economy as losses for lenders. Carrying less debt right now is probably wise.

Canadian citizens (not just our governments) have a lot of debt: two trillion dollars in mortgage debt alone. That means a mere 0.25 percentage point change in interest rates can drive a $5 billion annual shift in debt service cash flows nationwide (not all immediately, as fixed rate mortgages are only affected upon renewal). Interest rates have changed by much more than that, so this really reduces the collective discretionary spending available to Canadian households.

The Federal budget has come out by the time you're reading this, but when I was drafting it, I read an article with a preview and this quote from the Finance Minister:

"This support will be narrowly focused and fiscally responsible. The truth is we can't fully compensate every single Canadian for all of the effects of inflation or for elevated interest rates. To do so would only make inflation worse and force rates higher for longer."

This is another piece of evidence that balancing trying to control inflation and not overwhelming people too badly with rising interest rates is a pretty delicate task right now.

The topics in the previous paragraphs are all intertwined. I wrote on Facebook recently about what I labelled as "Canadian politics' Kobayashi Maru era:"

The way factors like demographics, healthcare needs, the housing market, the labour market, interest rates, and inflation are all colliding right now is boxing us into a corner.

As an example, consider the proposed healthcare deal between the Provinces and the Feds: $46 billion over ten years. That sounds like a lot of money—and it is—but I don't see it making much of a difference. New Brunswick is just over 2% of the Canadian population, so our share (assuming it gets divided roughly equally per capita) is around $1 billion over ten years. We already spend $3.2 billion per year on healthcare, though, so this is only around a 3% increase (on average—the funding is weighted more to the end of those ten years than the start but I haven't done a detailed year-by-year calculation). That probably won't even cover increased costs from the next round of collective bargaining agreements—note that salaries and benefits are a super-majority of healthcare costs.

What the premiers had asked for was more than 6x higher than what the Feds offered. This would put the funding boost in the 20% range, which... still seems low for keeping up with inflation and the increasing demand from an aging population. But that's a moot point anyway, because they're really not going to get everything they're asking for (no matter who the PM is, by the way; this is less a partisan issue than a matter of real-world constraints).

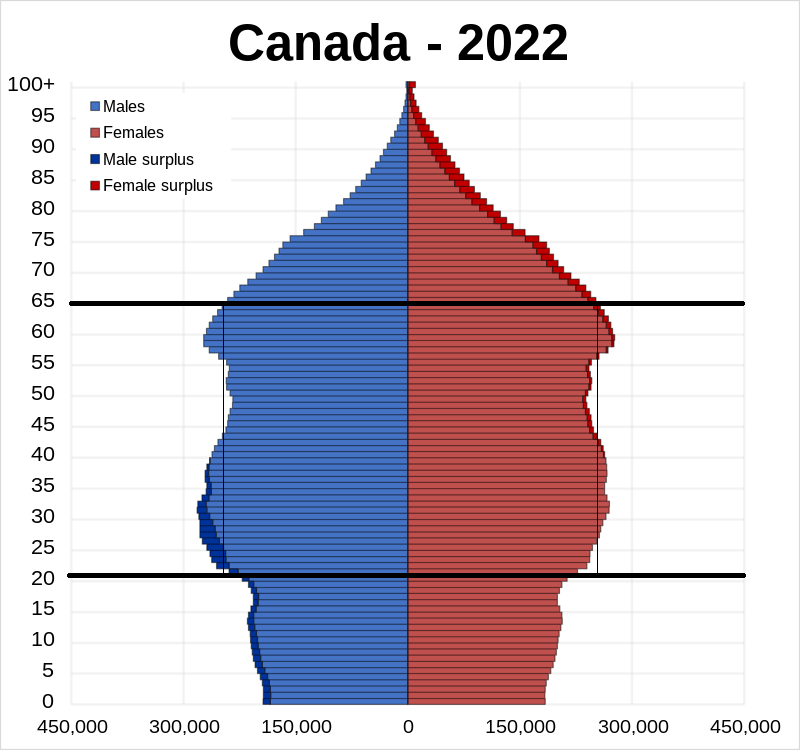

This graph shows one of the root issues: there are more people aging out of the workforce (upper horizontal line) every year than are aging into it (lower horizontal line)—and this gap will widen over the next half decade. It might not be a drastic decline in the working age population, but it's an inexorable one, and it'll be making the jobs of governments at levels that much harder. The logic of supply and demand should mean that compensation will increase, but the government is interested in controlling inflation and labour costs are a big contributor to prices—especially in the service sector (healthcare definitely included), which is a big part of our economy anyway and an especially big part of the consumption basket of retirees (who are often on fixed incomes and thus especially vulnerable to inflation). Raising interest rates is a tool used to control inflation. It reduces demand for homeownership (among other things), but the government doesn't want housing prices to fall too much because equity in their homes is a major part of a lot of Canadians' retirement savings and real estate is pretty much the largest sector of our economy so if it shrinks governments will face drops in tax revenue and run the risk of triggering a recession. On the flip side, increasingly expensive housing makes workers require higher wages, circling back to the previous point. And it's a component of inflation in its own right. A real Gordian knot.

I wrote this before the budget came out. Overall healthcare funding in New Brunswick ended up increasing by around 10%; I assume the specific deal between the Federal government and the provinces discussed here is related to the $87M increase in the Conditional Health Transfer.

Here is the graph referred to:

Resources and Further Reading

Finally, here are some links with references and related topics:

- The main budget document and a website with related documents (the budget speech and the capital budget).

- New Brunswick Economic Dashboard (gnb.ca) (the population is now over 820k).

- A profile of the provincial workforce and other reports that may be of interest.

- Is this an instance of "more centrifugal strain at a time when there are already a lot of domestic challenges to deal with, and the geopolitical milieu is also no longer something we can take for granted"?

- Matt Gurney: Let's talk about what Canada being broken means (substack.com)

- The NB population under 15 has stopped declining.

- Good news about our region: From bubble to boom? New report shows economic momentum in Atlantic Canada | CBC News